- 12 Apr 2023 22:56

#15271265

It's a mix of things, hiking interest rates helps to keep expectations anchored. That definitely helps.

Wandering the information superhighway, he came upon the last refuge of civilization, PoFo, the only forum on the internet ...

Moderator: PoFo Economics & Capitalism Mods

wat0n wrote:It's a mix of things, hiking interest rates helps to keep expectations anchored. That definitely helps.

Steve_American wrote:This is sort of true.

However, under MMT, the min. wage will be a socially inclusive wage with full benevits, incl. excellent healthcare insurance. So, somewhere areound $25/hr.

So, 1st almost everyone gets a big raise and then maybe, taxes are raised a little, but only if there is some inflation.

Also, a tax is a little effect on almost everyone, while raising interest rates gives income to some (bankers, etc.) and focuses the hurt on just a few, those who get lid off.

IMHO, the tax is more ethical.

.

Steve_American wrote:Yes, I'm sure that at least 1% (not 1%age point) in the reduction in the rate of inflation was caused by a change in expections. MS Econ talks about expectations too much. For example after the GFC in the EU it was argued that the austerity policy adopted would cause an increase in spending because people would have confidance that their taxes would not be being increased over the next few years. This didn't happen because corps didn't borrow to increase output until they saw more demand, and people didn't spend more to create more demand becuse their incomes fell and they could not borrow more. So, years later some MS Econ-ists admitted that they had been wrong about that.

Anyway, how did expectations reduce inflation? Some ways are =>

1] Corps reduce price increases because (reasons).

. . . This works best because this is the last decision that effects inflation.

2] The people reduce their spending because (reasons).

. . . This reduces demand which may caue corps to increase their prices less, or they can ignore it.

. . . The data shows that the GDP increased in Jan. '23 more than in Dec. '22 and increased in Fed. '23 also. So, little or no decrease in people's and corps' spending, likely an increase.

3] The people reduce their spending because they have been layed off.

. . . There is no hint in the data that anyone got laid off, not even the workers in the SVB after to was sold. Total employment increased more in Jan. '23 than it did in Dec. '22; and it increased in Feb. '23 also.

So, how did expectations reduce inflation?

Also, was the amount of reduction caused by changed expectations worth the cost to the people of the US. Banks and bankers got an increase in their income that came from some borrowers whose interest rates were increased. Also, from the US Gov. in interest on new bonds if the new bonds were sold at higher interest rates; was this a good thing? It will continue for years until the new bonds are retired.

.

wat0n wrote:What's the MMT explanation for e.g. the end of the hyperinflation in Israel in 1985 or Brazil in 1994?

https://en.wikipedia.org/wiki/1985_Isra ... ation_Plan

https://en.wikipedia.org/wiki/Plano_Real

Mainstream economists would say it stopped because expectations were finally anchored.

While inflation can be described as a general increase in the price level, or equivalently a fall in the purchasing power of a currency, hyperinflation is a different phenomenon entirely. Although definitions are in general rather arbitrary, many economists distinguish hyperinflation from merely high inflation by defining it as a price level increase of at least 50% per month (Cagen, 1956). This is in contrast with ‘normal’ inflation, which many countries, including the UK, target at 2% a year. Fortunately, hyperinflations tend to be rare, with around 56 occurrences in modern economic history.

. . .

A Cato Institute study of all 56 recorded hyperinflations found that hyperinflations only occur under extreme conditions such as war or a complete collapse in the productive capacity of a country [=stortages]. Hyperinflation has never been a consequence of monetary policy or politicians turning on the printing press just before an election; rather, hyperinflation is a symptom of a state that has lost control of its tax base.

. . .

The empirical reality, both when looking at quantitative data and qualitative descriptions of what actually happens in hyperinflations shows that they are not the results of well-governed states abusing the money creation process.

Some of its main points included:

A significant cut in government expenditures and deficit.

Reaching an agreement with the then-powerful Histadrut labor union to enact wage controls, thus decoupling rampant wage from price inflation.

Emergency measures imposing temporary price controls over a broad range of basic products and services.

A sharp devaluation of the Shekel, followed by a policy of a long-term fixed foreign exchange rate.

Curbing the Bank of Israel's ability to print money to cover government deficits.

Solution ---

The Plano Real intended to stabilize the domestic currency in nominal terms after a string of failed plans to control inflation. It created the Unidade Real de Valor (Real Unit of Value), which served as a key step to the implementation of the new (and still current) currency, the real. At first, most academics tended not to believe that the Plan could succeed. Stephen Kanitz was the first public intellectual to predict the future success of the Real Plan.[citation needed]

... nothing snipped...

A new currency called the real (plural reais) was introduced on 1 July 1994, as part of a broader plan to stabilize the Brazilian economy, replacing the short-lived cruzeiro real in the process. Then, a series of contracting fiscal and monetary policies was enacted, restricting the government expenses and raising interest rates. By doing so, the country was able to keep inflation under control for several years. In addition, high interest rates attracted enough foreign capital to finance the current account deficit and increased the country's international reserves. The government put a strong focus on the management of the balance of payments, at first by setting the real at a very high exchange rate relative to the U.S. dollar, and later (in late 1998) by a sharp increase on domestic interest rates to maintain a positive influx of foreign capitals to local currency bond markets, financing Brazilian expenditures.

wat0n wrote:@Steve_American in both cases, the measures enacted managed to put expected inflation under control.

If you want, we can talk about high inflation too. I just picked hyperinflation because it's an extreme example.

The best case I can think of is Chile, where managing expectations were able to end 70 years or so of an average inflation of 35%.

Steve_American wrote:OK, but it took a lot more than just increasing interest rates.

Steve_American wrote:I'm not sure about Chile, but it seems like it took a dictator and a lot of murders of poltical opposition to do it. Is this your understanding also? It doesn't seem like a good model for the US, if I'm right.

Steve_American wrote:Please, answer my question.

Is reducing the not that high inflation worth the damage it has done to the economy and the income transfered from some borrowers to the banks and bankers?

.

wat0n wrote:

What's worth is making sure the current inflation does not become permanent.

late wrote:When the economy is growing, a small amount of inflation can be a good thing. Unless you're all knowing, like the Q, you are going to overshoot or undershoot.

My feeling is the Fed overreacted.

wat0n wrote:Sure, but raising interest rates is just a tool to fulfill that goal. If inflation expectations are anchored, whatever excess inflation will be temporary as it won't translate into more widespread pressures in the economy.

It was done during democracy, in the 1990s. The dictatorship actually failed to achieve consistently low inflation and a growing economy, although it did help set the foundations for that to happen later.

What it's worth is making sure the current inflation does not become permanent. That is far, far worse than a temporary slowdown in economic growth and drop in incomes (I'll note the banks themselves are also under pressure due to the increase in interest rates).

wat0n wrote:

A "small amount" is 2%, not 8%.

wat0n wrote:

Fortunately, though, it seems core inflation is also coming under control but we're not out of the woods yet.

late wrote:We are never out of the woods. The idea that you can create a stable economy is partly myth. Like I said, the Fed is rich guys looking after their own.

The country is doing massive amounts of investment, add that to the worker shortage driving up wages, and you have a good economy. That's a good thing, and kicking it in the nuts is not good..

The American worker is underpaid, and by a lot. What they are trying to do is force wages down. When the Boomers were running around; it was easy. But doing it when there is a shortage of workers is foolish.

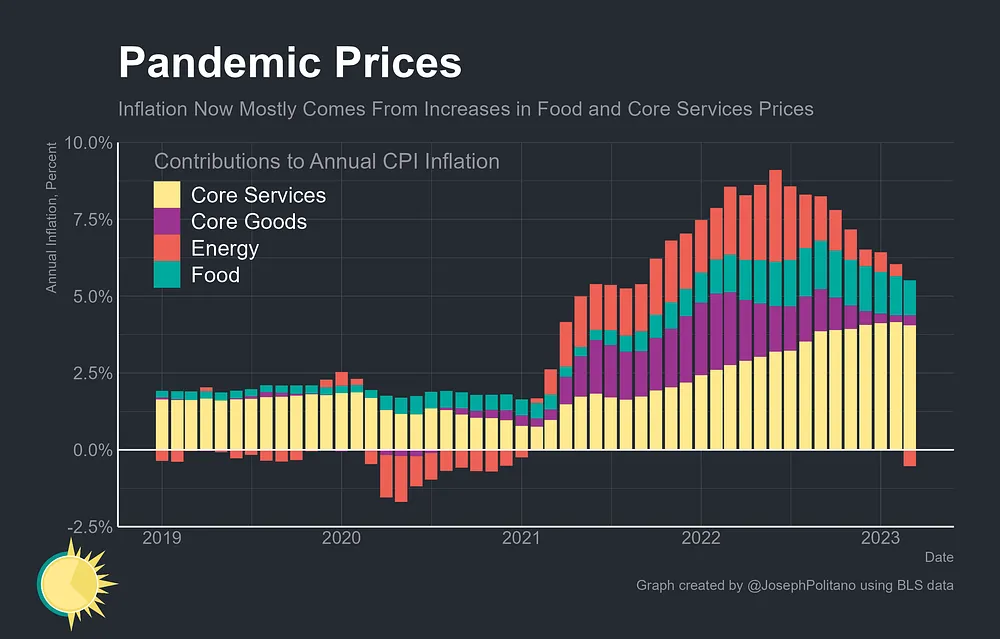

wat0n wrote:@late @Steve_American a part of the inflation we've had is indeed transient, but a part of it was actually threatening to become more permanent as the higher inflation has spread to the core index (taking out food and energy, which are more volatile/transient):

https://substack.com/profile/4569696-jo ... c-14546164

Fortunately, though, it seems core inflation is also coming under control but we're not out of the woods yet.

Steve_American wrote:All you ever do is make assertions of your opinion of what your conclusion is.

You think that just repeating your conclusion is going to convince me and the lurkers who don't already agree with you.

In this reply all you did is assume the inflation in the part of the economy labled "core" is somehow an indication that this inflation is going to continue unless stopped by interest rate increases. However, "core goods" and "core services" are just a name for all goods and servives except food and energy. In the past food and energy were separated out because they are very volitile with food being affected by droughts, etc., and energy being affected by the decissions of OPEC, etc.

. . . In this case, the supply chain problems caused shortages of computer chips and many other things that are 'goods' and are not food and energy. The shortages caused the prices of these things to increase [as shortages always have since, at least, the Bible was written]. Then owners of service business raised their prices when demand for their services picked up as fear of covid was reduced because their bussenesses and personal expences had increased and they wanted more profit=income as a result. These price increases are the inflation in 'core services'.

. . . In both kinds of core inflation the prices were driven up by things that were not being pushed up by wage increases, but by increases in non-wage business expenses and also a desire of small service business owerns to get more income after lockdowns were relaxed and people started spending on services again [also now without the fear of getting covid because they went out in public.]

. . . There was also price gouging by corps with monopoly pricing power, that is in industries that are "concentrated," meaning just around 5 places people can go to buy the stuff.

.

wat0n wrote:None of this explains clearly why has core service inflation gone up, too. Supply chain restrictions account for the increase in the inflation of goods minus food, but not the rest.

I will also note that we've gone back to normal for the most part but core services inflation has not clearly abated yet. Exactly my point.

Steve_American wrote:Because covid aid mostly went to big corps, maybe a lot of service comp. had to go out of business during the lockdowns. During covid spending was shifted from services to stuff. Stuff could be delivered, but services required you to do out in public to see aa movie in a theater, to get your hair cut, eat in a festuranr, etc. The surviving service bussiness owners hve the normal business person view that they can make up their missing profits, but workers should not be allowed to make up for their missing wages. So, the owners maybe continuing to increase their profits to make up for the profits they coulsn't earn during covid.

And again, the money supply theory of inflation was only proven with 1 or more false premises. This fact makes the proof invalid. There are also periods in economic history when the money supply grew a lot and inflation came under control or never increased over 2.5%/yr. Like the Reagan Admin. when the national debt tripled or qudrupled and inflation was reduced, if not stopped. Also, in Japan from 1998 to 2919. The existance of counter examples and a lack of a valid proof makes your accespance of the money supply theory of inflation questionable at best.

Also, banks lend out newly created dollarss and this increases the money supply, but MS Econ ignores these new dollars, why?

.

Can they just catch all the bits with a giant bag[…]

That idiot comedian going on about India is actual[…]

It now appears that Pres. Biden wasn't simply blu[…]