- 02 Sep 2023 05:26

#15285427

1] https://www.cnbc.com/2023/01/12/heres-t ... chart.html

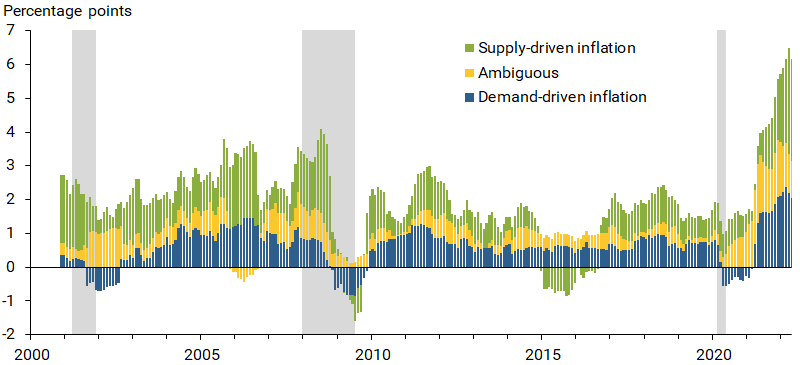

This source shows that US inflation was over 8% for about 9 mo. with an average rate of about 8.5%. So, 33% of that is 2.8%. This is 40% above the Fed's target inflation rate of 2%. I hope the Lurkers (there are over 350 of them now) can see that this is not a significant amount of "punishment" for 14 years of deficit spending (totally well over $10T IIRC) and $5.5T more covid spending. All that deficit spending was someone's income, and it stayed in the economy as income for others until it was parked by a saver in her savings acc.

2] The difference is the Japanese Gov. cares about its citizens' wellbeing. This is why it actually aims at full employment, instead of purposely causing unemployment like our Fed is now. So, it will not end its policy of aiding the zombie banks to punish someone (the owners?) knowing it will also take money from some innocent depositors who believed the Gov's promise to not take their money if they left it in that bank. Also, it is different from Lehman Brothers in that it is a decades-long settled policy, not a sudden unexpected situation.

3] This is just your assertion.

AFAIK, the Japanese Gov. is keeping the zombie banks going so they Will make loans to the citizens. It doesn't make much sense for the Gov. to punish a bank and some of its large depositors after years of support, because the bank "lent too much."

4] I asked for the exact way it does it not the name of the method.

AFAIK, Open Market operations means buying bonds on the secondary market to control the interest rate on new bonds being sold, so the Gov. pays less interest or to keep interest rates low in the economy. Just how does this reduce the M1 money supply?

5] AFAIK, the theory holds that (Because of the large on-going deficits) bond vigilantes will attack the Japanese bond market to force the Gov. and BoJ to let interest rates on new bond sales go way up. This has not happened in 30 years.

. . The interest rate on excess reserves in banks is -0,1%. This lets the Gov. sell its bonds at a rate close to +0.1%, giving a yield of just 0.2%, and this is enough for the Japanese to buy the bonds. Note that, about 40% of outstanding bonds are owned by the BoJ. Yet the bond vigilantes can't force interest rates up.

I'm sorry, but I don't see how the zero lower bound makes Japan different from all other nations when it comes to the bond vigilantes' ability to force interest rates on Gov. bonds up. Can you explain how you think it works?

______________________________._______________________________________

For the record and the Lurkers' information, MMTers assert that the Mainstream theories are wrong. This mostly because they were not changed when Nixon took the world off the psudo-gold standard in 1971. This made all currencies into fiat currencies.

. . This meant that Gov. no longer needed to protect their gold supply. They had been doing this by restricting the amount of deficit spending so that there would not be enough mny for some group of "vigilantes" to have enough currency to demand all the gold in the nation's possession. They also sold bonds to convert some currency which was backed by gold into interest bearing bonds that could not be used to demand gold. But, still there was felt to be a limit on how big the national debt could be without there being problems with the gold supply.

. . So, even 10 years after 1871 in 1981, when Reagan took office, the US national debt was just $1T. This was because the theory held that the Gov. must not expand the debt much more than that. At one point in a fit of honesty, Dich Cheney actually said what MMTers are saying, i.e., "That Reagan proved that deficits don't matter". Obviously, Reagan also thought the total debt doesn't matter (despite his lying rhetoric), because he blew up the debt by $2T to $3T more debt (depending on what counts as debt). Note, the relative size of that increase. If Obama had tripled or quadrupled the size of the debt, when he left office, the debt would have been between $31.8T and $42.4T (he started with a debt of $10.6T). Instead, he left the office with a debt of about $18.5T. This shows you just how radical Reagan's policies were from what went before.

.

wat0n wrote:1] That sounds more like it. 33% is fairly substantial in all.

2] It's not impossible. Why did the Bush admin refuse to bail Lehman Brothers out? It had done so for Bear Sterns.

3] That risk can perfectly suppress lending.

4] Open market operations.

5] The theory applies differently for Japan because of the zero lower bound. It's not possible, in practice, for central banks to set a negative nominal interest rate.

1] https://www.cnbc.com/2023/01/12/heres-t ... chart.html

This source shows that US inflation was over 8% for about 9 mo. with an average rate of about 8.5%. So, 33% of that is 2.8%. This is 40% above the Fed's target inflation rate of 2%. I hope the Lurkers (there are over 350 of them now) can see that this is not a significant amount of "punishment" for 14 years of deficit spending (totally well over $10T IIRC) and $5.5T more covid spending. All that deficit spending was someone's income, and it stayed in the economy as income for others until it was parked by a saver in her savings acc.

2] The difference is the Japanese Gov. cares about its citizens' wellbeing. This is why it actually aims at full employment, instead of purposely causing unemployment like our Fed is now. So, it will not end its policy of aiding the zombie banks to punish someone (the owners?) knowing it will also take money from some innocent depositors who believed the Gov's promise to not take their money if they left it in that bank. Also, it is different from Lehman Brothers in that it is a decades-long settled policy, not a sudden unexpected situation.

3] This is just your assertion.

AFAIK, the Japanese Gov. is keeping the zombie banks going so they Will make loans to the citizens. It doesn't make much sense for the Gov. to punish a bank and some of its large depositors after years of support, because the bank "lent too much."

4] I asked for the exact way it does it not the name of the method.

AFAIK, Open Market operations means buying bonds on the secondary market to control the interest rate on new bonds being sold, so the Gov. pays less interest or to keep interest rates low in the economy. Just how does this reduce the M1 money supply?

5] AFAIK, the theory holds that (Because of the large on-going deficits) bond vigilantes will attack the Japanese bond market to force the Gov. and BoJ to let interest rates on new bond sales go way up. This has not happened in 30 years.

. . The interest rate on excess reserves in banks is -0,1%. This lets the Gov. sell its bonds at a rate close to +0.1%, giving a yield of just 0.2%, and this is enough for the Japanese to buy the bonds. Note that, about 40% of outstanding bonds are owned by the BoJ. Yet the bond vigilantes can't force interest rates up.

I'm sorry, but I don't see how the zero lower bound makes Japan different from all other nations when it comes to the bond vigilantes' ability to force interest rates on Gov. bonds up. Can you explain how you think it works?

______________________________._______________________________________

For the record and the Lurkers' information, MMTers assert that the Mainstream theories are wrong. This mostly because they were not changed when Nixon took the world off the psudo-gold standard in 1971. This made all currencies into fiat currencies.

. . This meant that Gov. no longer needed to protect their gold supply. They had been doing this by restricting the amount of deficit spending so that there would not be enough mny for some group of "vigilantes" to have enough currency to demand all the gold in the nation's possession. They also sold bonds to convert some currency which was backed by gold into interest bearing bonds that could not be used to demand gold. But, still there was felt to be a limit on how big the national debt could be without there being problems with the gold supply.

. . So, even 10 years after 1871 in 1981, when Reagan took office, the US national debt was just $1T. This was because the theory held that the Gov. must not expand the debt much more than that. At one point in a fit of honesty, Dich Cheney actually said what MMTers are saying, i.e., "That Reagan proved that deficits don't matter". Obviously, Reagan also thought the total debt doesn't matter (despite his lying rhetoric), because he blew up the debt by $2T to $3T more debt (depending on what counts as debt). Note, the relative size of that increase. If Obama had tripled or quadrupled the size of the debt, when he left office, the debt would have been between $31.8T and $42.4T (he started with a debt of $10.6T). Instead, he left the office with a debt of about $18.5T. This shows you just how radical Reagan's policies were from what went before.

From the internet=> On January 20, 2009, the day Mr. Obama took office, the debt stood at $10.626 trillion.

.

- By wat0n

- By wat0n